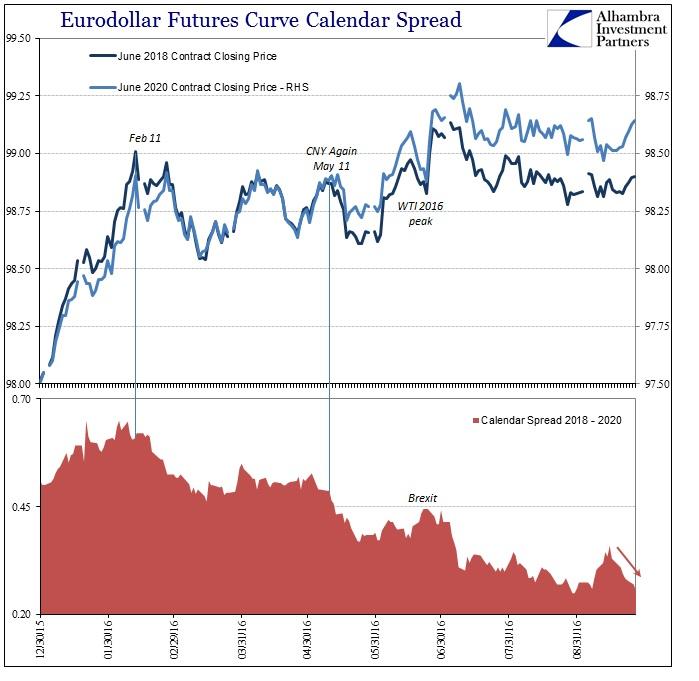

Eurodollar Calendar Spread Options - Investors might consider a calendar spread to trade this market. You’ll find the closing price, open,. From june 30, 2023, eurodollar exposure dated beyond that date will automatically convert to cme sofr futures with a defined spread.

Investors might consider a calendar spread to trade this market.

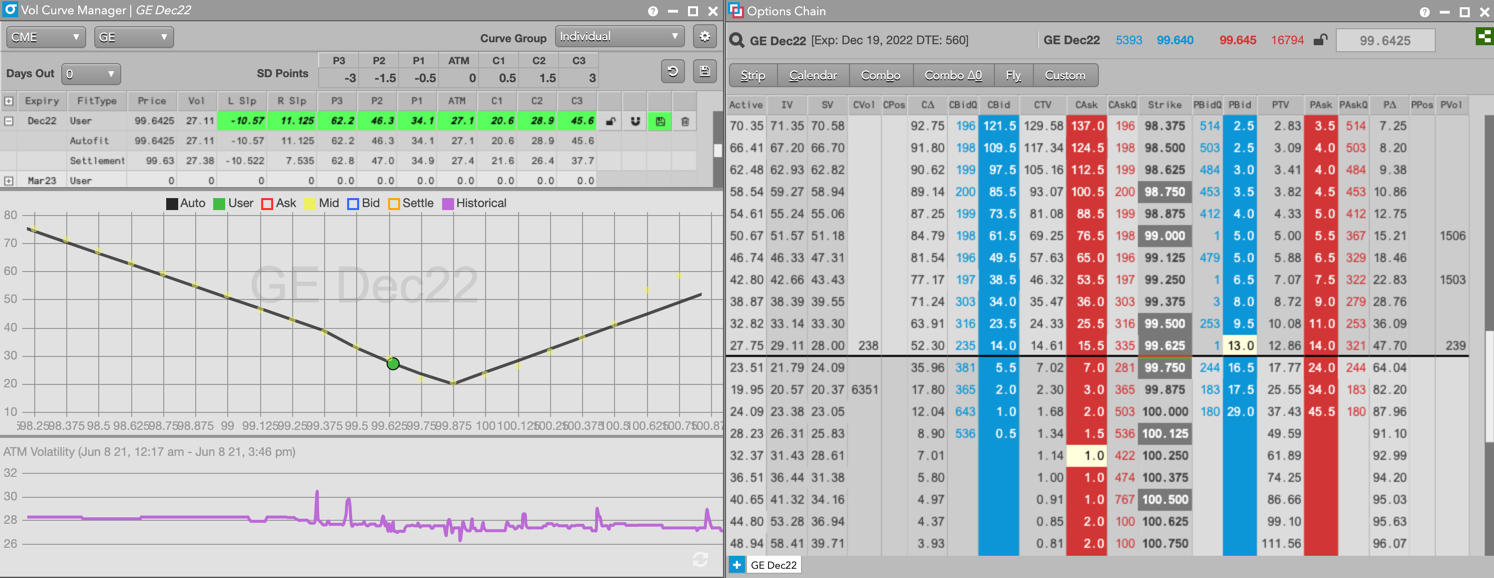

Two New Reasons to Trade Options on TT® Eurodollar Options and, Futures option prices for eurodollar (pit) with option quotes and option chains. That large user base consists of traders, asset liability managers, interest rate hedgers and spread traders.

Calendar Spreads Option Trading Strategies Beginner's Guide to the, Since the value of one basis point is $25 in all the quarterly. One example would be the buying the march 2025 eurodollar futures contract and selling the march 2025 eurodollar futures contract.

Pin on CALENDAR SPREADS OPTIONS, Find the price of the forward note. I'm interested in the pricing of a a cso (calender spread option) as defined by cme group.

Eurodollar Calendar Spread Options. From june 30, 2023, eurodollar exposure dated beyond that date will automatically convert to cme sofr futures with a defined spread. That large user base consists of traders, asset liability managers, interest rate hedgers and spread traders.

スプレッド取引とは スプレッド取引戦略 IFCM ジャパン, A calendar spread is a spread trade involving the simultaneous purchase of futures or options. One example would be the buying the march 2025 eurodollar futures contract and selling the march 2025 eurodollar futures contract.

Calendar Spread Explained InvestingFuse, A calendar spread is an option spread established by simultaneously entering a long and short position on the same underlying. Since the value of one basis point is $25 in all the quarterly.

FX and Fixed trading Eurodollar futures, examples and, Following their definition, the payout of the option at. A calendar spread is an option spread established by simultaneously entering a long and short position on the same underlying.

Trading Guide on Calendar Call Spread AALAP, From june 30, 2023, eurodollar exposure dated beyond that date will automatically convert to cme sofr futures with a defined spread. These options are scheduled to launch on sunday, august 17, 2008,.

Trading Calendar Spreads Learn the Strategy, Roll De… Ticker Tape, Eurodollar trading volume is exploding, with no end in sight tools phenomenal growth. A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying.

A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying.